Understanding A Company’s Liquid Assets: The Lifeblood Of Operations

Understanding a Company’s Liquid Assets: The Lifeblood of Operations

Related Articles: Understanding a Company’s Liquid Assets: The Lifeblood of Operations

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Understanding a Company’s Liquid Assets: The Lifeblood of Operations. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Understanding a Company’s Liquid Assets: The Lifeblood of Operations

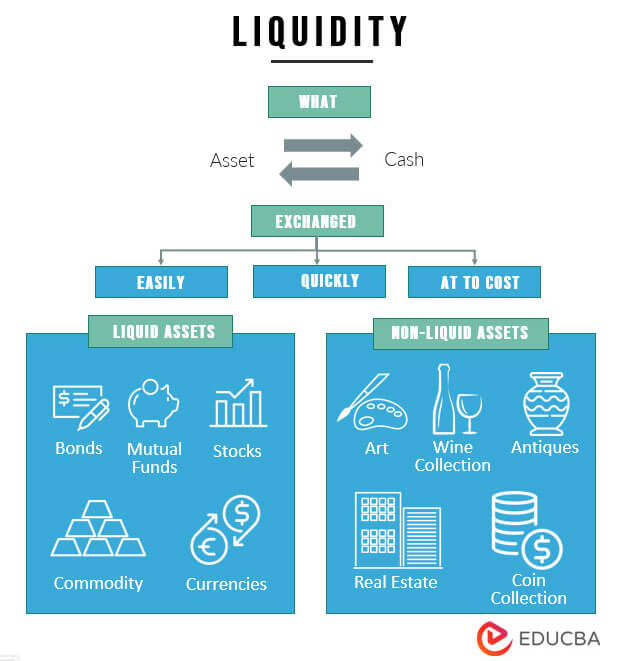

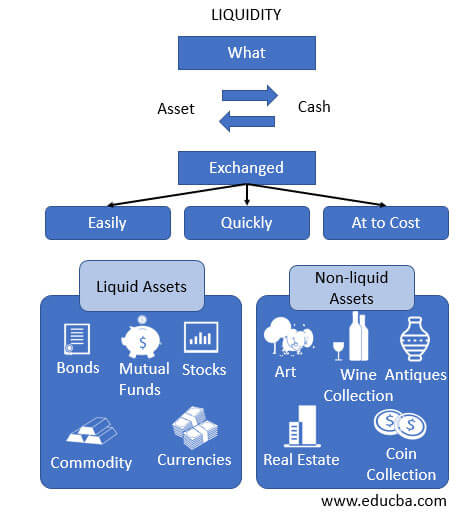

In the dynamic world of business, a company’s success hinges on its ability to manage its resources effectively. One crucial aspect of this management is the understanding and utilization of liquid assets. These are the company’s resources that can be readily converted into cash within a year. They represent the company’s immediate financial flexibility and play a critical role in its day-to-day operations and future growth.

Defining Liquid Assets: A Deeper Dive

Liquid assets are not simply any asset a company owns; they are characterized by their liquidity, meaning their ability to be easily and quickly converted into cash without significant loss in value. This characteristic distinguishes them from other assets like property, equipment, or long-term investments that may take time and effort to convert into cash.

Here’s a breakdown of the key types of liquid assets:

-

Cash and Cash Equivalents: This category includes the most liquid assets, such as cash on hand, funds held in bank accounts, and short-term investments like treasury bills that mature within a year. These assets are readily available for immediate use.

-

Accounts Receivable: This represents the money owed to the company by its customers for goods or services already delivered. While not cash in hand, accounts receivable can be quickly converted into cash through collections.

-

Inventory: For businesses that sell goods, inventory is a crucial liquid asset. It represents the raw materials, work-in-progress, and finished goods that are available for sale. The faster inventory is sold, the quicker it converts into cash.

-

Marketable Securities: These are short-term investments in publicly traded stocks or bonds that can be easily bought and sold on the market. They offer potential for capital gains and can be readily converted into cash.

The Importance of Liquid Assets

The significance of liquid assets cannot be overstated. They are the lifeblood of a company, enabling it to:

-

Meet Short-Term Obligations: Liquid assets provide the necessary funds to pay for immediate expenses such as salaries, rent, utilities, and supplier payments. Without adequate liquidity, a company could face serious financial difficulties.

-

Fund Operations: Liquid assets are essential for financing the company’s day-to-day operations, including purchasing inventory, marketing products, and providing customer support.

-

Seize Opportunities: A healthy level of liquid assets allows a company to capitalize on unexpected opportunities, such as acquiring a competitor or expanding into new markets.

-

Manage Risk: Liquid assets serve as a buffer against unforeseen events, such as economic downturns or unexpected expenses. They provide financial flexibility to weather difficult times.

-

Attract Investors: Companies with strong liquidity are generally viewed as more stable and reliable, making them more attractive to investors. This can lead to easier access to financing and lower borrowing costs.

Analyzing Liquid Assets: Key Metrics

To understand a company’s financial health, it’s essential to analyze its liquid assets through key metrics:

-

Current Ratio: This ratio measures a company’s ability to meet its short-term obligations using its current assets. A higher current ratio generally indicates stronger liquidity.

-

Quick Ratio: This ratio is similar to the current ratio but excludes inventory, providing a more conservative measure of liquidity.

-

Cash Conversion Cycle: This metric measures the time it takes for a company to convert its investments in inventory and other resources into cash. A shorter cycle indicates more efficient use of resources and stronger liquidity.

Managing Liquid Assets for Optimal Performance

Effective management of liquid assets is crucial for a company’s long-term success. Here are some key strategies:

-

Forecasting and Planning: Accurate forecasting of cash flows and expenses is essential for managing liquidity effectively. A company should develop a comprehensive cash flow plan to ensure sufficient funds are available to meet its obligations.

-

Inventory Management: Optimizing inventory levels is critical for maximizing liquidity. Companies should strive to maintain just enough inventory to meet demand without tying up too much cash in unsold goods.

-

Efficient Collections: Prompt collection of accounts receivable is vital for maintaining strong liquidity. Companies should implement efficient collection processes and consider offering incentives for early payments.

-

Short-Term Financing: If a company experiences temporary cash flow shortages, it can consider short-term financing options like lines of credit or commercial paper. However, these options should be used judiciously to avoid excessive debt.

-

Investment Strategies: Companies can invest excess liquidity in short-term investments to generate returns while maintaining easy access to cash.

FAQs on Liquid Assets:

Q: What is the difference between liquid assets and current assets?

A: All liquid assets are current assets, but not all current assets are liquid. Current assets include all assets that are expected to be converted into cash or used up within a year. Liquid assets are a subset of current assets that can be readily converted into cash without significant loss in value.

Q: Why is liquidity important for a growing company?

A: For growing companies, liquidity is particularly crucial. They need sufficient funds to finance expansion, invest in new products or services, and acquire other businesses. Strong liquidity gives them the financial flexibility to pursue growth opportunities.

Q: How can a company improve its liquidity?

A: Companies can improve their liquidity by implementing a combination of strategies, including:

- Improving inventory management: Reducing excess inventory and optimizing stock levels.

- Enhancing collection processes: Speeding up the collection of accounts receivable.

- Negotiating better payment terms with suppliers: Extending payment terms to improve cash flow.

- Exploring short-term financing options: Securing lines of credit or other short-term financing when needed.

Q: What are the risks associated with low liquidity?

A: Low liquidity can lead to:

- Inability to meet short-term obligations: This can result in late payments, penalties, and even bankruptcy.

- Missed growth opportunities: Lack of liquidity can prevent a company from taking advantage of promising opportunities.

- Increased borrowing costs: Companies with low liquidity may have to pay higher interest rates on loans.

- Loss of investor confidence: Low liquidity can signal financial instability and discourage investors.

Tips for Managing Liquid Assets:

- Regularly monitor cash flow: Track cash inflows and outflows to identify potential liquidity issues early on.

- Develop a comprehensive cash flow plan: Forecasting cash flows and expenses helps ensure sufficient funds are available to meet obligations.

- Implement efficient collection procedures: Promptly collect accounts receivable to minimize the amount of cash tied up in outstanding invoices.

- Maintain a healthy level of liquid assets: Aim for a current ratio and quick ratio that are appropriate for the industry and company size.

- Seek professional advice: Consult with financial advisors to develop a sound liquidity management strategy.

Conclusion:

Liquid assets are the foundation of a company’s financial health and a key driver of its success. By understanding the importance of liquid assets, analyzing key metrics, and implementing effective management strategies, companies can ensure they have the financial flexibility to meet their obligations, seize opportunities, and achieve their goals. Strong liquidity is not just a financial metric; it is a critical element of a company’s long-term sustainability and growth.

:max_bytes(150000):strip_icc()/LiquidAsset-905fb5eaaa4e4154bc15e512c015eee1.jpg)

Closure

Thus, we hope this article has provided valuable insights into Understanding a Company’s Liquid Assets: The Lifeblood of Operations. We hope you find this article informative and beneficial. See you in our next article!

You may also like

Recent Posts

- Navigating The Academic Landscape: A Comprehensive Guide To The DGF School Calendar

- Mastering Your Week: The Power Of A Weekly To-Do Calendar

- The Enduring Utility Of Whiteboard Calendars: A Comprehensive Guide

- Navigating Your Academic Journey: A Comprehensive Guide To The UC Clermont Calendar

- Navigating The Path To Success: A Guide To The ELAC Summer 2025 Calendar

- Navigating The Future: A Comprehensive Guide To The 2025 Yearly Calendar

- Navigating Your Academic Journey: A Comprehensive Guide To The George Mason University Calendar

- The Power Of Calendar Subscriptions On IPhone: Streamlining Your Life One Event At A Time

Leave a Reply