Navigating The Currency Market: Understanding The Significance Of An Exchange Rate Calendar

Navigating the Currency Market: Understanding the Significance of an Exchange Rate Calendar

Related Articles: Navigating the Currency Market: Understanding the Significance of an Exchange Rate Calendar

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Currency Market: Understanding the Significance of an Exchange Rate Calendar. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating the Currency Market: Understanding the Significance of an Exchange Rate Calendar

- 2 Introduction

- 3 Navigating the Currency Market: Understanding the Significance of an Exchange Rate Calendar

- 3.1 What is an Exchange Rate Calendar?

- 3.2 Why is an Exchange Rate Calendar Important?

- 3.3 Key Components of an Exchange Rate Calendar

- 3.4 How to Use an Exchange Rate Calendar Effectively

- 3.5 Frequently Asked Questions about Exchange Rate Calendars

- 3.6 Tips for Using an Exchange Rate Calendar for Informed Decision-Making

- 3.7 Conclusion

- 4 Closure

Navigating the Currency Market: Understanding the Significance of an Exchange Rate Calendar

:max_bytes(150000):strip_icc()/what-are-exchange-rates-3306083_FINAL-ad4aa801c7ff4b52810c734d345dc401.png)

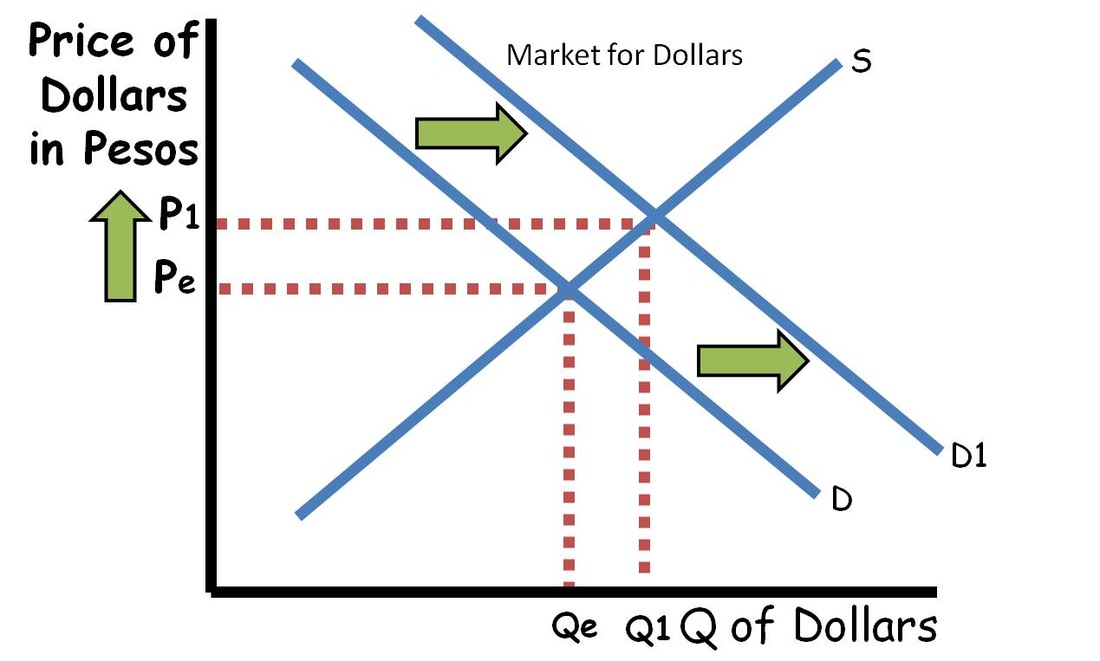

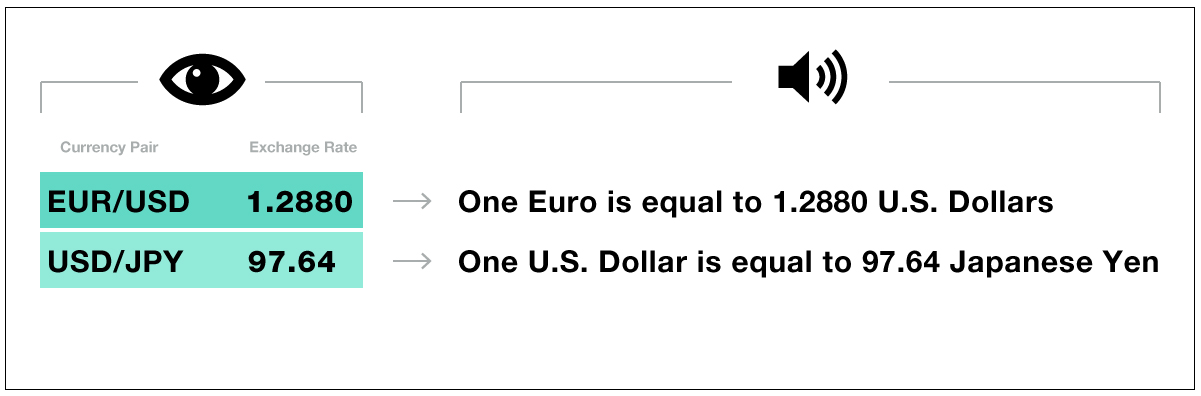

The global financial landscape is a complex tapestry of interconnected markets, with currencies playing a pivotal role. Understanding the forces that drive currency fluctuations is crucial for businesses, investors, and individuals alike. One powerful tool for navigating this dynamic environment is an exchange rate calendar.

This comprehensive guide delves into the intricacies of an exchange rate calendar, exploring its components, benefits, and practical applications. By understanding this valuable resource, individuals can gain a deeper understanding of currency dynamics and make informed decisions in the global marketplace.

What is an Exchange Rate Calendar?

An exchange rate calendar is a meticulously curated compilation of economic events, data releases, and central bank announcements that can significantly impact currency values. It acts as a roadmap, highlighting key dates and times when these events are scheduled, allowing users to anticipate potential market movements.

Why is an Exchange Rate Calendar Important?

The significance of an exchange rate calendar lies in its ability to:

- Provide a Clear Picture of Potential Market Volatility: By outlining upcoming economic releases and policy announcements, the calendar helps anticipate potential market shifts, allowing for proactive decision-making.

- Enhance Trading Strategies: Traders and investors can leverage the calendar to identify potential trading opportunities by understanding the impact of upcoming events on currency pairs.

- Improve Risk Management: By understanding the potential for market volatility associated with upcoming events, individuals can adjust their risk management strategies accordingly.

- Boost Investment Decisions: Investors can use the calendar to assess the potential impact of economic data releases on their investment portfolios, optimizing their asset allocation.

- Facilitate Business Transactions: Businesses operating in the global market can use the calendar to anticipate currency fluctuations, enabling them to make informed decisions regarding pricing, hedging, and international payments.

Key Components of an Exchange Rate Calendar

An effective exchange rate calendar typically includes the following elements:

-

Economic Data Releases: This encompasses a wide range of data points, including:

- Inflation: Measures like Consumer Price Index (CPI) and Producer Price Index (PPI) reflect the rate of price increases in an economy.

- Gross Domestic Product (GDP): A measure of the overall economic output of a country.

- Employment Data: Unemployment rates, job creation figures, and wage growth data provide insights into the health of the labor market.

- Trade Balance: The difference between a country’s exports and imports, reflecting its trade performance.

- Manufacturing and Industrial Production: Indicators of the health of the manufacturing and industrial sectors.

- Consumer Confidence: Surveys that gauge consumer sentiment and spending intentions.

- Retail Sales: Data on consumer spending patterns, providing insights into economic activity.

- Central Bank Announcements: Monetary policy decisions, including interest rate changes and asset purchase programs, can significantly impact currency values.

- Political Events: Major political events, such as elections, referendums, and policy announcements, can influence market sentiment and currency movements.

- Holidays: Recognizing key national holidays can help understand potential market closures and reduced trading activity.

How to Use an Exchange Rate Calendar Effectively

To maximize the benefits of an exchange rate calendar, consider the following:

- Focus on High-Impact Events: Prioritize your attention on events that are likely to have a significant impact on currency values.

- Analyze Past Data: Examine historical data related to past events and their impact on currency movements to gain insights into potential future trends.

- Consider the Context: Evaluate events within the broader economic and political context to understand their potential impact on currency values.

- Utilize Multiple Resources: Consult various exchange rate calendars and economic news sources to gain a comprehensive view of upcoming events.

- Stay Updated: Regularly check for calendar updates and changes, as economic conditions and policy announcements can shift rapidly.

Frequently Asked Questions about Exchange Rate Calendars

1. What is the difference between an economic calendar and an exchange rate calendar?

While both calendars provide information on upcoming economic events, an exchange rate calendar specifically focuses on events that can significantly impact currency values. It highlights data releases, central bank announcements, and political events that are likely to influence currency movements.

2. How often should I check the exchange rate calendar?

For active traders and investors, it’s recommended to check the calendar daily to stay updated on upcoming events and potential market shifts. Individuals with less frequent trading activity can check the calendar weekly or even monthly, depending on their needs.

3. Can I rely solely on the exchange rate calendar for making trading decisions?

While the calendar provides valuable insights, it’s important to consider other factors, such as fundamental analysis, technical indicators, and market sentiment, before making any trading decisions.

4. Where can I find a reliable exchange rate calendar?

Numerous reputable financial websites and trading platforms offer free access to exchange rate calendars. Some popular sources include Bloomberg, Reuters, Investing.com, and Forex Factory.

5. Are there any limitations to using an exchange rate calendar?

While the calendar offers a valuable framework for understanding potential market movements, it’s essential to remember that it’s a tool for analysis, not a guarantee of future outcomes. Market reactions to economic data and policy announcements can be unpredictable, and other unforeseen events can also influence currency values.

Tips for Using an Exchange Rate Calendar for Informed Decision-Making

- Focus on Key Currencies: Identify the currencies that are most relevant to your trading or investment activities and prioritize your attention on events related to those currencies.

- Track Major Economic Releases: Pay close attention to the release dates of key economic indicators, such as GDP, inflation data, and employment figures.

- Analyze Central Bank Statements: Carefully review central bank announcements and statements for hints about future policy decisions and potential impact on currency values.

- Monitor Political Developments: Stay informed about major political events, such as elections, referendums, and policy changes, as they can significantly influence market sentiment and currency movements.

- Consider the Impact of Unexpected Events: Be aware that unforeseen events, such as natural disasters, global crises, or geopolitical tensions, can also have a significant impact on currency values.

Conclusion

An exchange rate calendar is an indispensable tool for navigating the complex world of currency markets. By understanding the impact of economic data releases, central bank announcements, and political events, individuals can make informed decisions regarding trading, investment, and business transactions. While the calendar provides valuable insights, it’s essential to remember that it’s a tool for analysis, not a guarantee of future outcomes. By combining the calendar with other analytical tools and a prudent approach to risk management, individuals can enhance their understanding of currency dynamics and position themselves for success in the global marketplace.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Currency Market: Understanding the Significance of an Exchange Rate Calendar. We hope you find this article informative and beneficial. See you in our next article!

You may also like

Recent Posts

- Navigating The Academic Landscape: A Comprehensive Guide To The DGF School Calendar

- Mastering Your Week: The Power Of A Weekly To-Do Calendar

- The Enduring Utility Of Whiteboard Calendars: A Comprehensive Guide

- Navigating Your Academic Journey: A Comprehensive Guide To The UC Clermont Calendar

- Navigating The Path To Success: A Guide To The ELAC Summer 2025 Calendar

- Navigating The Future: A Comprehensive Guide To The 2025 Yearly Calendar

- Navigating Your Academic Journey: A Comprehensive Guide To The George Mason University Calendar

- The Power Of Calendar Subscriptions On IPhone: Streamlining Your Life One Event At A Time

Leave a Reply