Navigating The Complexities Of The CGST Calendar: A Comprehensive Guide

Navigating the Complexities of the CGST Calendar: A Comprehensive Guide

Related Articles: Navigating the Complexities of the CGST Calendar: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Complexities of the CGST Calendar: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating the Complexities of the CGST Calendar: A Comprehensive Guide

- 2 Introduction

- 3 Navigating the Complexities of the CGST Calendar: A Comprehensive Guide

- 3.1 Understanding the Core Components of the CGST Calendar

- 3.2 The Significance of the CGST Calendar: A Guide to Efficient Compliance

- 3.3 Demystifying the CGST Calendar: Practical Applications and Key Considerations

- 3.4 Frequently Asked Questions (FAQs) Regarding the CGST Calendar

- 3.5 Tips for Effective Utilization of the CGST Calendar

- 3.6 Conclusion: Embracing the CGST Calendar for Seamless Compliance

- 4 Closure

Navigating the Complexities of the CGST Calendar: A Comprehensive Guide

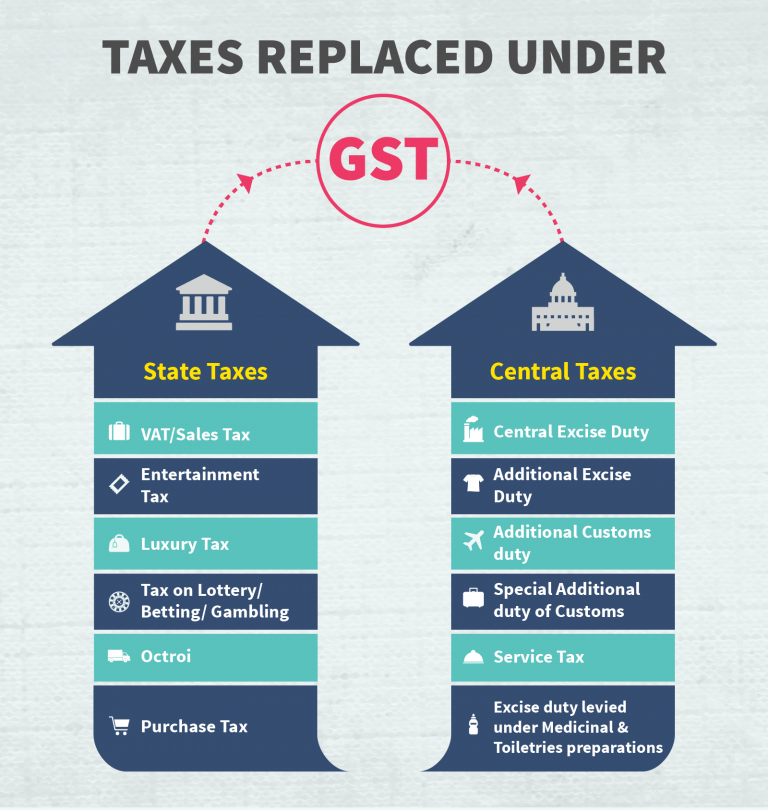

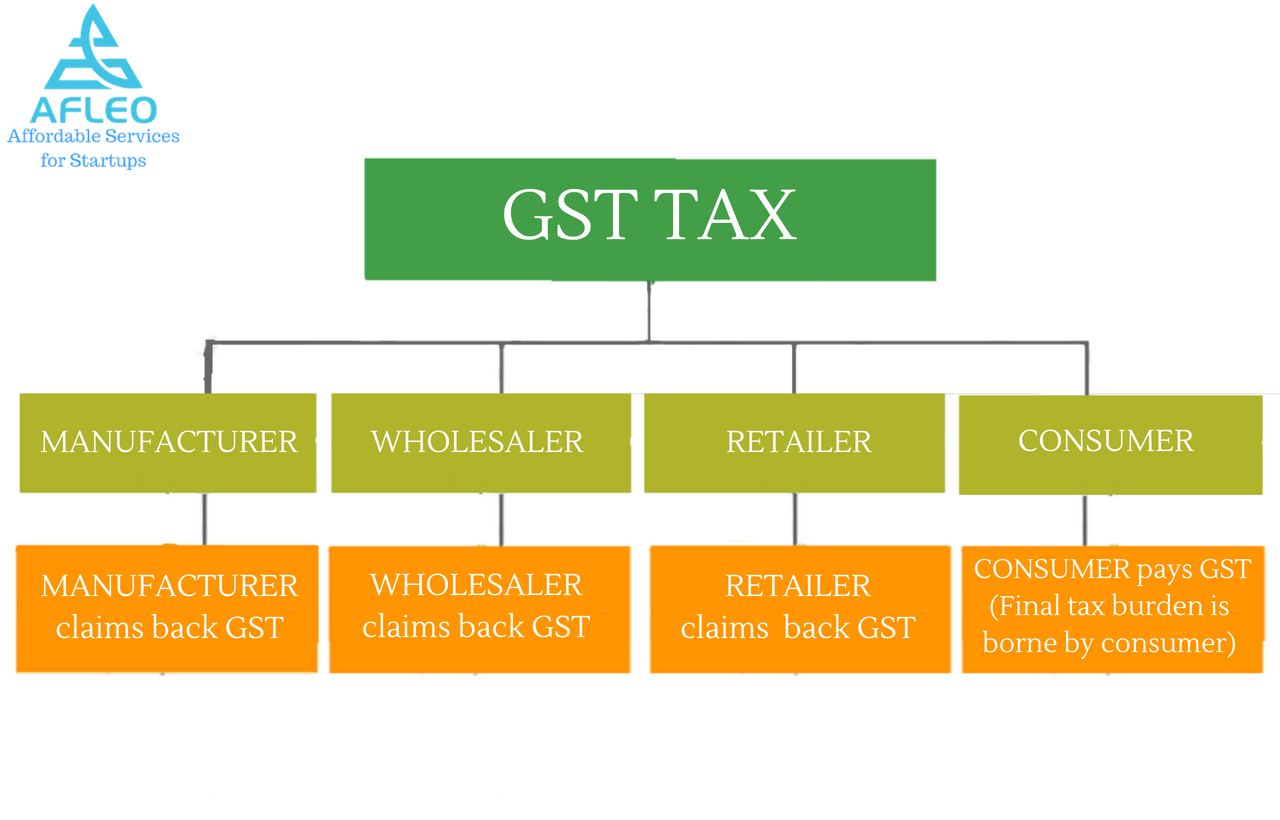

The Goods and Services Tax (GST) regime in India, implemented in 2017, has significantly transformed the country’s tax landscape. Centralized under the Central Goods and Services Tax (CGST) Act, the system necessitates a clear understanding of the various deadlines and compliance requirements. This comprehensive guide aims to demystify the intricacies of the CGST calendar, providing a detailed understanding of its key components, importance, and practical applications.

Understanding the Core Components of the CGST Calendar

The CGST calendar, a crucial tool for taxpayers, outlines the deadlines for various GST-related activities. These activities include:

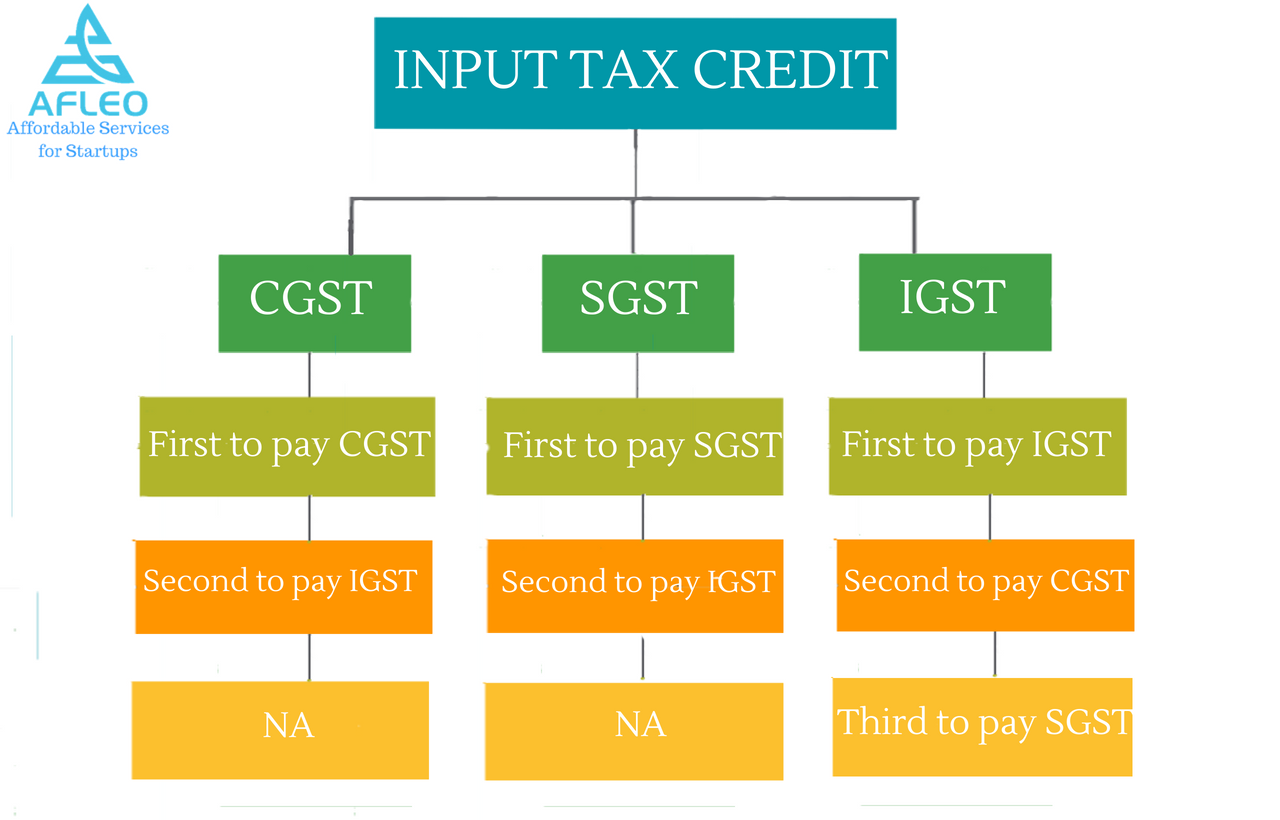

- Filing GST Returns: The calendar outlines the specific dates for filing various GST returns, such as GSTR-1, GSTR-3B, GSTR-9, and others. These returns capture details of sales, purchases, and input tax credit utilization.

- Payment of GST: The calendar details the due dates for GST payments, ensuring timely compliance with tax obligations.

- Reconciliation and Compliance: The calendar aids in tracking the deadlines for reconciling GST data, ensuring accuracy and compliance with relevant regulations.

- Annual Filing: The calendar provides information on the due dates for annual filing requirements, including the filing of annual returns and audits.

The Significance of the CGST Calendar: A Guide to Efficient Compliance

The CGST calendar serves as a critical tool for businesses operating under the GST regime. Its significance can be understood through the following points:

- Maintaining Compliance: The calendar ensures adherence to statutory deadlines, minimizing the risk of penalties and legal repercussions for non-compliance.

- Streamlined Operations: By providing a clear schedule, the calendar allows businesses to plan their tax-related activities efficiently, minimizing disruptions to their operations.

- Financial Planning: The calendar assists in budgeting and financial planning by providing a clear picture of tax liabilities and payment schedules.

- Transparency and Accountability: The calendar promotes transparency and accountability, ensuring a fair and equitable tax system for all stakeholders.

Demystifying the CGST Calendar: Practical Applications and Key Considerations

Understanding the practical applications of the CGST calendar is crucial for businesses to navigate the complexities of the GST regime effectively.

Key Considerations for Taxpayers:

- Understanding Different Return Types: Each GST return serves a specific purpose. For instance, GSTR-1 details outward supplies, while GSTR-3B summarizes tax liabilities. Understanding the purpose of each return is essential for accurate reporting.

- Staying Updated with Amendments: The CGST calendar is subject to changes and amendments. Regularly checking the official website of the GST Council is essential to stay updated.

- Avoiding Last-Minute Rush: The calendar allows businesses to plan their tax-related activities well in advance, avoiding the last-minute rush and potential errors.

- Utilizing Technology: Several online platforms and software tools are available to assist with GST compliance, including filing returns and generating invoices.

Frequently Asked Questions (FAQs) Regarding the CGST Calendar

Q1: What are the consequences of missing a deadline on the CGST calendar?

A: Missing a deadline can result in penalties, late fees, and even legal action. The severity of the consequences depends on the specific deadline missed and the nature of the non-compliance.

Q2: How can I access the CGST calendar?

A: The CGST calendar is available on the official website of the GST Council. It can also be accessed through various online portals and software platforms.

Q3: Can I file my GST returns before the due date?

A: Yes, you can file your GST returns before the due date. This is recommended to avoid any last-minute delays or technical issues.

Q4: What happens if I have a technical issue while filing my GST return?

A: In case of technical issues, it is recommended to contact the GST helpline or seek assistance from a tax professional.

Q5: How can I stay updated on any changes or amendments to the CGST calendar?

A: Regularly checking the official website of the GST Council, subscribing to relevant newsletters, and consulting with tax professionals are some ways to stay updated.

Tips for Effective Utilization of the CGST Calendar

- Maintain a Dedicated Calendar: Create a dedicated calendar or use software tools to mark all important GST-related deadlines.

- Set Reminders: Set reminders for upcoming deadlines to ensure timely compliance.

- Seek Professional Advice: Consult with a tax professional for guidance on complex compliance requirements.

- Utilize Online Resources: Leverage online platforms and software tools for efficient GST compliance.

- Stay Informed: Regularly update yourself on any changes or amendments to the CGST calendar.

Conclusion: Embracing the CGST Calendar for Seamless Compliance

The CGST calendar is an indispensable tool for navigating the complexities of the GST regime. Its effective utilization ensures timely compliance, minimizes risks, and promotes smooth business operations. By understanding the calendar’s structure, deadlines, and applications, businesses can achieve seamless compliance and navigate the GST landscape with confidence.

Remember, staying informed and proactively managing tax obligations is crucial for long-term success within the Indian tax system. Consistent adherence to the CGST calendar fosters a compliant and efficient business environment, contributing to a robust and thriving economy.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Complexities of the CGST Calendar: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!

You may also like

Recent Posts

- Navigating The Academic Landscape: A Comprehensive Guide To The DGF School Calendar

- Mastering Your Week: The Power Of A Weekly To-Do Calendar

- The Enduring Utility Of Whiteboard Calendars: A Comprehensive Guide

- Navigating Your Academic Journey: A Comprehensive Guide To The UC Clermont Calendar

- Navigating The Path To Success: A Guide To The ELAC Summer 2025 Calendar

- Navigating The Future: A Comprehensive Guide To The 2025 Yearly Calendar

- Navigating Your Academic Journey: A Comprehensive Guide To The George Mason University Calendar

- The Power Of Calendar Subscriptions On IPhone: Streamlining Your Life One Event At A Time

Leave a Reply